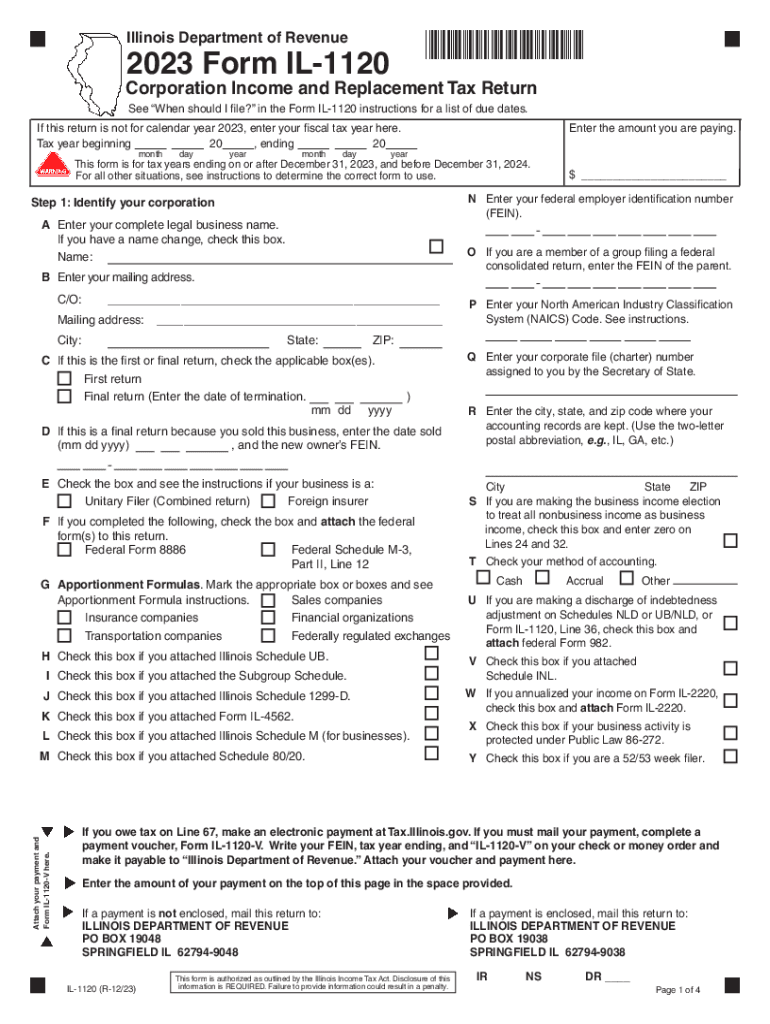

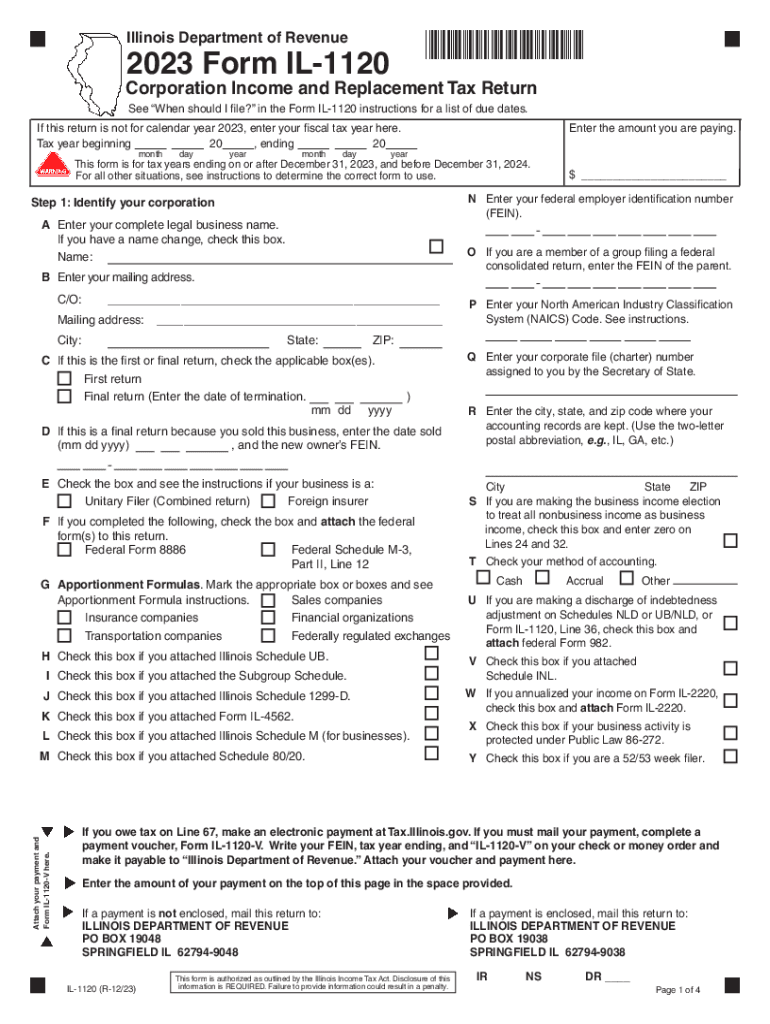

IL DoR IL-1120 2023-2024 free printable template

Get, Create, Make and Sign

How to edit 2022 il 1120 online

IL DoR IL-1120 Form Versions

How to fill out il 1120 2023-2024 form

How to fill out 2023 il-1120-st-villinois department of

Who needs 2023 il-1120-st-villinois department of?

Video instructions and help with filling out and completing 2022 il 1120

Instructions and Help about 1120 corporation tax return form

In this video let's take a look at the corporate tax return let's form 1120 here for the year 2018 really calendar year 2018 if it's not the calendar year then you have to type in or fill in the physical year here at the top name of the corporation address city state zip code if it's changed from the previous year you need to check off the boxes here if this is the first return creating a new corporation that would be checked off here so if this is the final return which we'll talk about in the quotations in the next couple chapters there's a box for that off to the left side are other boxes we had talked about consolidated returns where you combine the parent and subsidiaries net income or loss here this is an election using this form 8 5 1 special rules apply to farms and here insurance company's personal holding companies we talked about in a previous chapter personal service corporations usually like a medical practice or even an accounting or a legal practice their profit is taxed at are usually a higher rate in past years it was 35 for 2018 now it's the same flat rate as a regular cooperation, so I'm not sure the significance now of a personal service cooperation unless there are some limitations between the reducibility of when the officers or the employees who own the company get paid when they can deduct the or crew the costs on the corporate return this first section for income pretty much the same as a Schedule C that we had seen back in our first chapter except maybe if you'll take a look at line eight here it says capital gains net capital gains being added in, but you don't see capital losses being deducted because we learned here in Chapter five net capital losses cannot be deducted to offset the other income of the corporation you get to carry forward that capital loss really carried back for the past three years and then carried forward for the past for next five years we had talked about depreciation recapture ordinary income here I guess it was two chapters ago and a miscellaneous income figure here okay going further down the form the deductions let's take a look at some of them they were mentioned here in Chapter five that can be different from on our corporations income statement we had maybe compensation two highly paid officers in the case of those being paid over a million dollars possibly any excess is non-deductible bad debt expense remember for tax purposes you have to use a direct write-off method versus possibly the allowance method that's utilized on the financial statements something a little I mentioned maybe earlier was the calculation of the state income taxes being deducted here on the federal return so pretty much you need to finish the state tax return first to complete your federal tax return you need to possibly accrue that state income tax and deduct it under state income tax return and whatever tax you have on the state tax return you're going to deduct it over here on the federal return we saw interest...

Fill il 1120 v : Try Risk Free

People Also Ask about 2022 il 1120

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your il 1120 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.